A Newbie's Guideline to Investing Abroad Futures: Unlocking World wide Alternatives

Wiki Article

Buying and selling abroad futures delivers traders the possibility to get involved in international markets, diversify their portfolios, and faucet into opportunities past their residence nation. No matter whether you’re aiming to hedge from challenges or speculate on selling price movements, buying and selling futures on Worldwide exchanges might be a powerful system. This information will check out what overseas futures are, how they work, and what you have to know to begin.

What exactly are Overseas Futures?

Abroad futures are standardized contracts traded on Global exchanges, wherever the customer agrees to get, and the seller agrees to provide, a particular asset in a predetermined selling price on the long term day. These property can range from commodities like oil and gold to economical instruments such as international indices or bonds. By trading futures on global exchanges, traders can access a big range of marketplaces and get exposure to Intercontinental economic tendencies.

1722493534.gif)

How can Abroad Futures Trading Perform?

Choosing a global Trade: The first step in buying and selling abroad futures is to select the suitable exchange. Well-known Intercontinental futures exchanges include things like the Tokyo Commodity Exchange (TOCOM), Eurex in Europe, plus the Singapore Trade (SGX). Each exchange presents different futures contracts, so your selection will count on the markets you’re serious about.

Opening a Futures Buying and selling Account: To trade abroad futures, you’ll have to open up a futures investing account using a broker that gives entry to Intercontinental markets. Be certain the broker is highly regarded and delivers the necessary instruments, study, and aid for buying and selling on world wide exchanges.

Knowing Margin Needs: Identical to domestic futures buying and selling, abroad futures generally need you to definitely deposit a margin—a portion of the total agreement worth—as collateral. Margin demands fluctuate dependant upon the exchange, the asset getting traded, as well as agreement measurement.

Forex Factors: When investing futures on Global exchanges, currency fluctuations can impression your returns. You’ll must consider the Trade price between your private home currency and the forex from the Trade. Some traders use currency hedging procedures to mitigate this possibility.

Industry Several hours and Time Zones: Given that abroad futures are traded on exchanges in numerous time zones, it’s crucial to know about the market hrs. This could call for you to regulate your trading program to align Together with the opening several hours of international markets.

Settlement and Shipping and delivery: Futures contracts is usually settled either by means of Actual physical supply from the asset or through hard cash settlement. Most retail traders opt for income settlement, wherever the distinction between the contract cost and the market price tag at expiration is paid out out. Make certain to be familiar with the settlement terms from the contracts you’re trading.

Advantages of Trading Overseas Futures

International Diversification: Trading overseas futures enables you to diversify your portfolio by gaining exposure to distinctive economies, commodities, and economical devices around the world.

Usage of Rising Marketplaces: Global futures exchanges give use of emerging markets, which can offer higher advancement opportunity as compared to extra made marketplaces.

Hedging Options: Overseas futures can be employed to hedge from currency risk, geopolitical events, and other world variables That may impact your investments.

Leveraged Buying and selling: Futures trading allows you to Regulate a substantial position with a comparatively little degree of money, thanks to leverage. This tends to amplify your prospective returns, though What's more, it increases possibility.

Dangers of Buying and selling Abroad Futures

Currency Possibility: Fluctuations in exchange costs can impact the value of your respective overseas futures contracts, resulting in opportunity losses.

Regulatory Distinctions: Distinctive nations have various polices, which may have an impact on how futures contracts are traded and settled. It’s crucial to familiarize by yourself with The foundations of the exchange you’re buying and selling on.

Time Zone Troubles: Investing in different time zones could be hard, particularly when it requires you to monitor markets in the course of non-conventional hours.

Marketplace Volatility: Worldwide markets could be hugely unstable, and gatherings which include political instability or financial downturns may lead to sharp rate actions.

Getting going with Abroad Futures Buying and selling

To begin buying and selling overseas futures, begin by studying international marketplaces and pinpointing the exchanges and contracts that align with all your expense goals. Open up a investing account that has a broker that gives entry to these marketplaces, and ensure to familiarize by yourself with the particular guidelines and specifications of the exchanges you’ll be investing on. Start off tiny and steadily increase your publicity as you attain practical experience and self confidence within your investing tactic.

Conclusion

Abroad futures trading offers a unique option for traders to expand their horizons and tap into global marketplaces. Whilst it comes along with its personal list of problems, the opportunity rewards is usually significant for people who take some time to understand the markets, take care of dangers proficiently, and stay knowledgeable about Intercontinental developments. By approaching overseas futures trading that has a well-imagined-out system, you'll be able to unlock new avenues for expansion and diversification in your expenditure portfolio.

By educating you around the intricacies of overseas futures buying and selling, you can also make educated decisions and confidently navigate the complexities of the global economic markets.

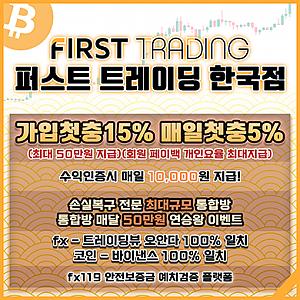

Get more info. here: fx시티